Getty Images

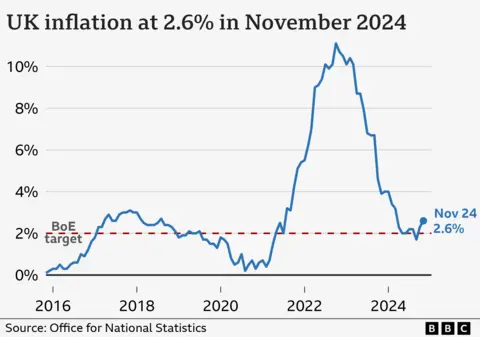

Getty ImagesThe UK inflation rate has gone up for the second month in a row, with prices rising at their fastest pace since March.

Inflation hit 2.6% in the year to November, according to official figures.

Fuel and clothing were among the main drivers behind the rise. Increasing ticket prices for gigs and plays were also a factor.

Analysts say the latest figures mean the Bank of England will almost certainly not cut interest rates when it meets on Thursday.

“Inflation rose again this month as prices of motor fuel and clothing increased this year but fell a year ago,” said Grant Fitzner, chief economist at the Office for National Statistics (ONS), which gathered the data.

“This was partially offset by air fares, which traditionally dip at this time of year, but saw their largest drop in November since records began at the start of the century.”

Chancellor Rachel Reeves said she recognised that families were still struggling with the cost of living.

“Today’s figures are a reminder that for too long the economy has not worked for working people.”

“I am fighting to put more money in the pockets of working people.”

Inflation, while higher than earlier in the year, is well below its peak in late 2022.

It has fallen steadily over the past two years and undershot the Bank of England’s 2% target in September, before rising again in October.

The official forecasting body said in October that inflation was likely to pick up to 2.6% in 2025 in part due to the impact of Budget measures announced in October.

Shadow chancellor Mel Stride said: “The chancellor has made a series of irresponsible and inflationary decisions.”

“These figures mean higher costs in the shops, less money in working people’s pockets and risks keeping mortgage rates higher for longer,” he said.

Prices for food and non-alcoholic drinks, alcohol and tobacco, and footwear all rose at a faster pace last month.

A wider measure of inflation showed housing and household services costs, including rent, rose by 3.5% over the past year.

Sarah Coles, head of personal finance at the financial services firm, Hargreaves Lansdown, said: “Inflation is staying put for now, like an unwelcome Christmas party guest hogging the sofa into the small hours.

“The question is whether it can be shifted, or if it’s going to hang around to ruin our plans for months – eating us out of house and home and driving up the cost of everything again,” she said.

‘A tough year’

Businesses like Miller’s Fish and Chips, in Haxby, Yorkshire, are also feeling the pressure from rising prices.

“It’s been a tough year” said David Miller.

“We’ve taken a hit with our bottom line because of fuel, obviously the utilities going up.”

“But I think the biggest thing overall for any business is wages,” he said.

Miller’s employs 60 people and tries to pay above the minimum wage.

Wage costs for businesses will rise again in April, after measures announced in October’s Budget come into force.

Rate decision

The Bank of England will have to weigh up competing arguments over whether to cut interest rates.

Recent figures show the economy shrank in September and October, and the usual response would be to lower interest rates.

That would ease the pressure on mortgage-holders and other borrowers, including businesses and should boost spending and investment.

However, rising prices, combined with figures on Tuesday that showed faster growth in wages, suggest rates may need to remain at their current 4.75% for longer, to keep inflation in check.

Many economists now expect interest rates to fall more slowly next year than had been expected previously.

Paul Dales, chief UK economist at the think tank, Capital Economics, said November’s higher inflation figure made it very unlikely interest rates would be cut on Thursday.

“There is almost no chance of the Bank of England delivering an early Christmas present with another interest rate cut tomorrow, ” he said.

“That’s especially the case since domestic inflation pressures appear to be a touch stronger than the Bank expected.”

Capital Economics predicts inflation will dip in December and then rise again in January, but by the end of next year would have fallen back to close to the Bank of England’s 2% target.